...

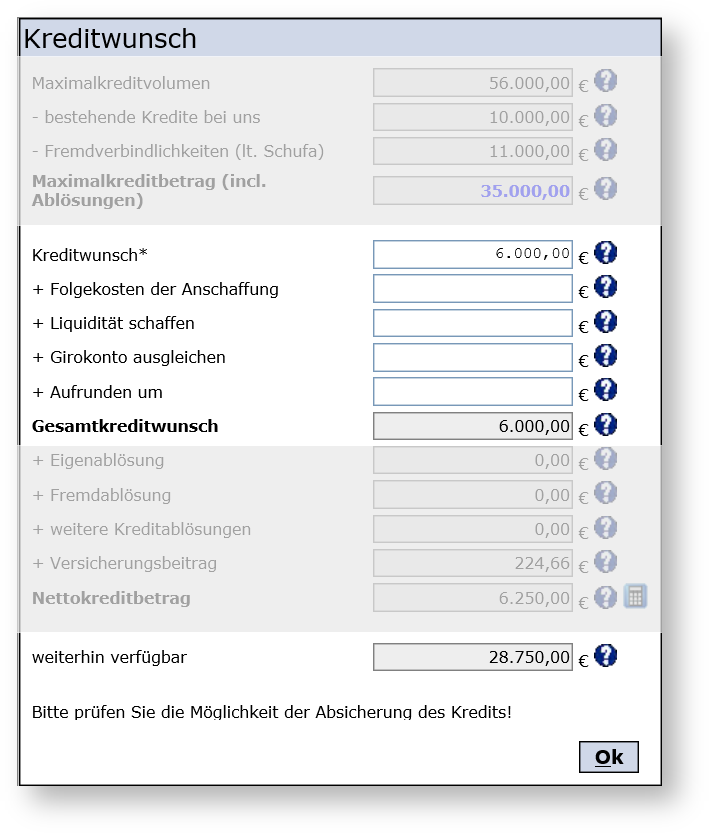

The aim of upselling is to determine a customer's further financial requirements, taking into account other aspects such as the follow-up costs of purchases, the settlement of current accounts or other cash requirements that are not related to the stated purpose.

In up-selling, further financial requirements are determined on the basis of the credit request. For example, this helps to take into account the follow-up costs of purchases, the settlement of a current account or to provide further liquidity.

...

There are products that are directly related to the consumer loan in question, such as insurance, but also products such as overdraft facilities, credit cards or other products from the bank’s portfolio or that of a partner.

...