FlexFinance provides data marts with values that entirely cover the calculation of risk provisions. For more information on the calculation options, please have a look at the section Workbenches for risk provisioning.

The data marts include:

- Calculated results

- PD (Probability of Default)

- LGD (Loss Given Default)

- EAD (Exposure at Default)

- ECL (Expected Credit Loss)

- Accounting-specific results based on the financial year

- Risk provisions

- Impairment expense

- Write-off expense

- Impairment income

- Detailed information regarding calculations

- Recovery cash flow plan for deals in default

- Drilldown to ECL calculations for each set date LGD (PIT) (= point in time)

- Sensitivity analysis: difference compared to current ECL due to changes in macroeconomic parameters

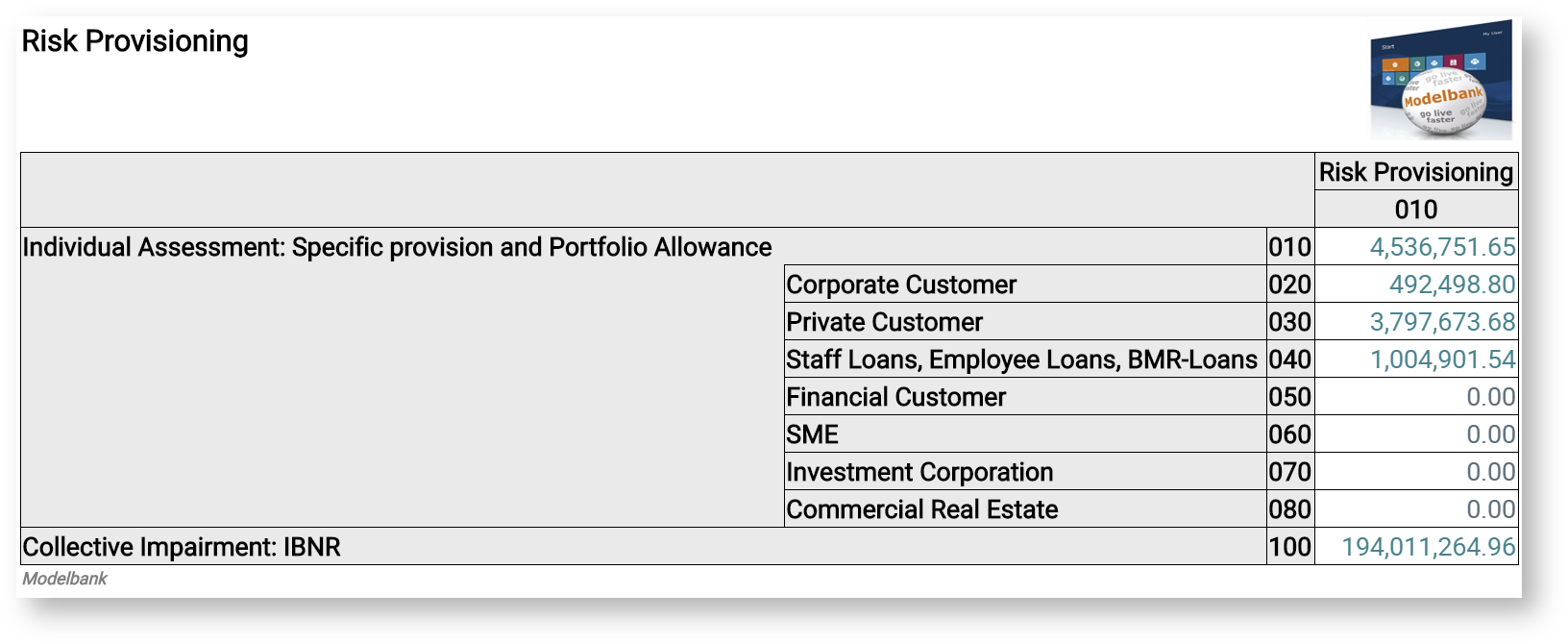

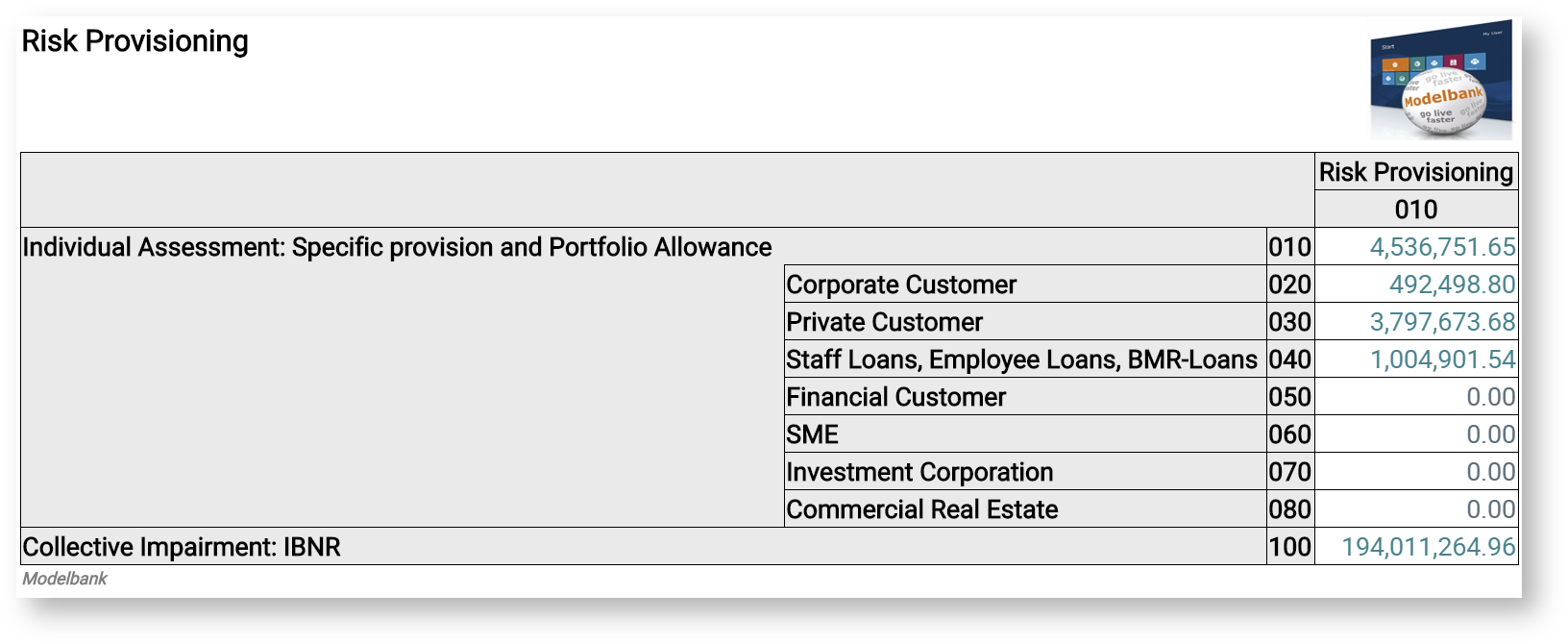

Below are some examples of reports on risk provisioning in FlexFinance based on these data marts:

The following standard functions are also available for reports defined in FlexFinance: